$FCX: Freeport-McMoRan - The Pure Play on Copper’s Coming Decade

Why the world’s largest copper miner is positioned to capture the full upside of a structural shortage

Copper is essential to modern electrification due to its superior electrical conductivity, which has no viable substitute at scale. The metal is critical across every major infrastructure category: power transmission and distribution networks, electric motors, transformers, renewable energy systems, and data centers. A single wind turbine contains several tons of copper. An electric vehicle requires four times the copper of a conventional car. A data center relies on miles of copper wiring for power delivery and cooling systems. The energy transition cannot proceed without adequate copper supply.

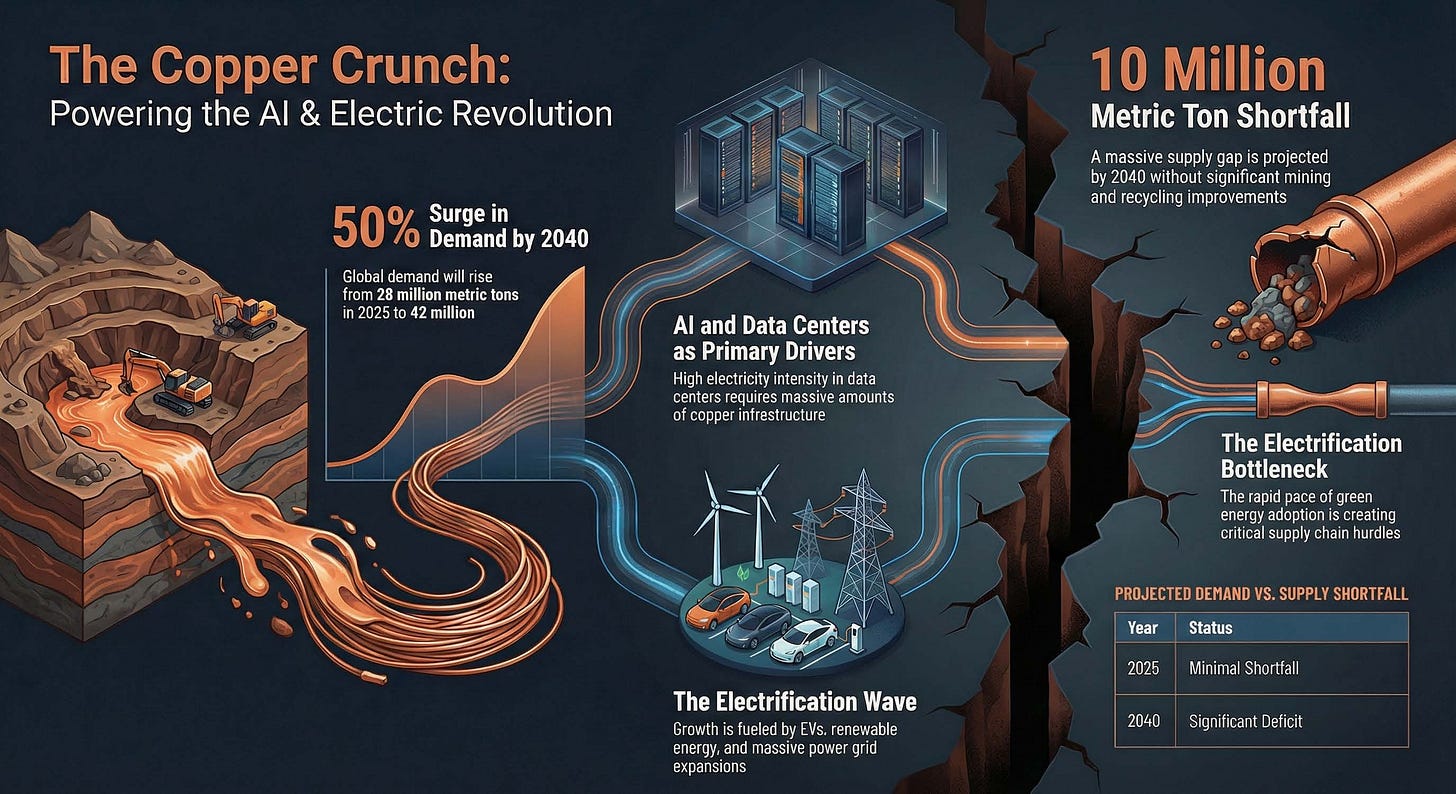

The global economy is heading into a copper crisis driven by forces on both sides of the market.

On the demand side:

AI data centers requiring massive power infrastructure

Electric vehicles replacing traditional combustion engines

Renewable energy installations (solar, wind)

Grid modernization and electrification

On the supply side:

New mines take 15-20 years from discovery to production

Existing deposits depleting with falling ore grades

Major discoveries collapsed 90% over two decades

Chronic underinvestment in exploration

Analysts from S&P Global to the IEA project deficits starting in 2026 that could reach 10 million tons annually by 2040, representing a quarter of total demand.

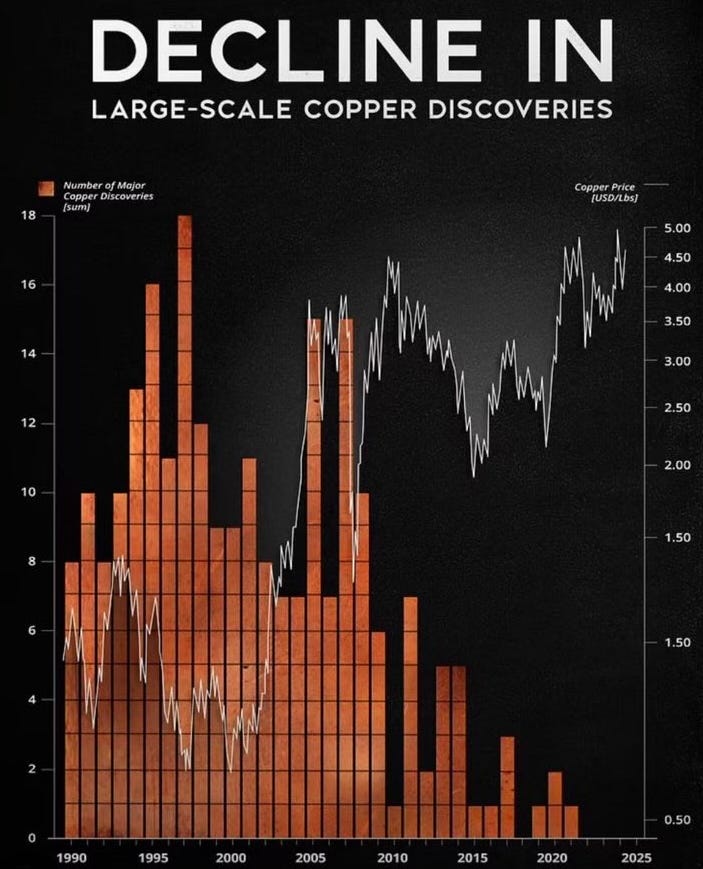

The Discovery Crisis

The copper supply side has slowly collapsed. Major copper discoveries have plummeted over 90% in the last two decades. In 1997, the industry found 18 major deposits. Between 2019 and 2023, there were only four discoveries worldwide, totaling just 4.2 million tons of new copper. Companies have slashed exploration budgets for new deposits, instead focusing on squeezing more output from aging mines with declining ore grades.

This creates a timing mismatch that can’t be fixed. Even if exploration budgets doubled tomorrow, new discoveries take 16-20 years on average to reach production, with some projects in the U.S. requiring nearly three decades. The pipeline is empty with no way to refill it quickly. Meanwhile, copper demand is accelerating from electrification, AI data centers requiring massive power infrastructure, and the global push toward renewables. The deficit projected to start in 2026 will only widen through 2030 and beyond, making this copper bull market both inevitable and multi-year in duration.

Freeport-McMoRan ($FCX) offers direct exposure to this copper shortage as the world's largest publicly traded pure-play producer.

Maximum Leverage to Rising Prices

As the largest publicly traded pure-play copper producer with minimal diversification into other metals, $FCX earnings swing harder than diversified miners like BHP or Rio Tinto who split focus across iron ore and other commodities. Every $1,000 per ton increase in copper prices translates directly to the bottom line.

Production Growth at the Perfect Time

New low-cost output from U.S. leaching operations is coming online just as the shortage intensifies. While competitors face depleting grades and rising costs, $FCX is expanding capacity to capture surging demand that can’t be met elsewhere.

Structural Tailwinds Locked In

Copper prices are already above $13,000 per ton and heading higher as deficits widen. Supply constraints are guaranteed for at least a decade since new mines take 15-20 years to develop. No quick fixes are available through recycling, substitution, or efficiency gains.

The alignment is clear: a structural copper shortage converging with the largest pure-play producer. Freeport-McMoRan ($FCX) sits at that intersection.