$FWONK: Formula 1's Growth Lap: Early Data Signals an Undervalued Growth Trajectory

FWONK | Momentum Ahead of Investor Recognition

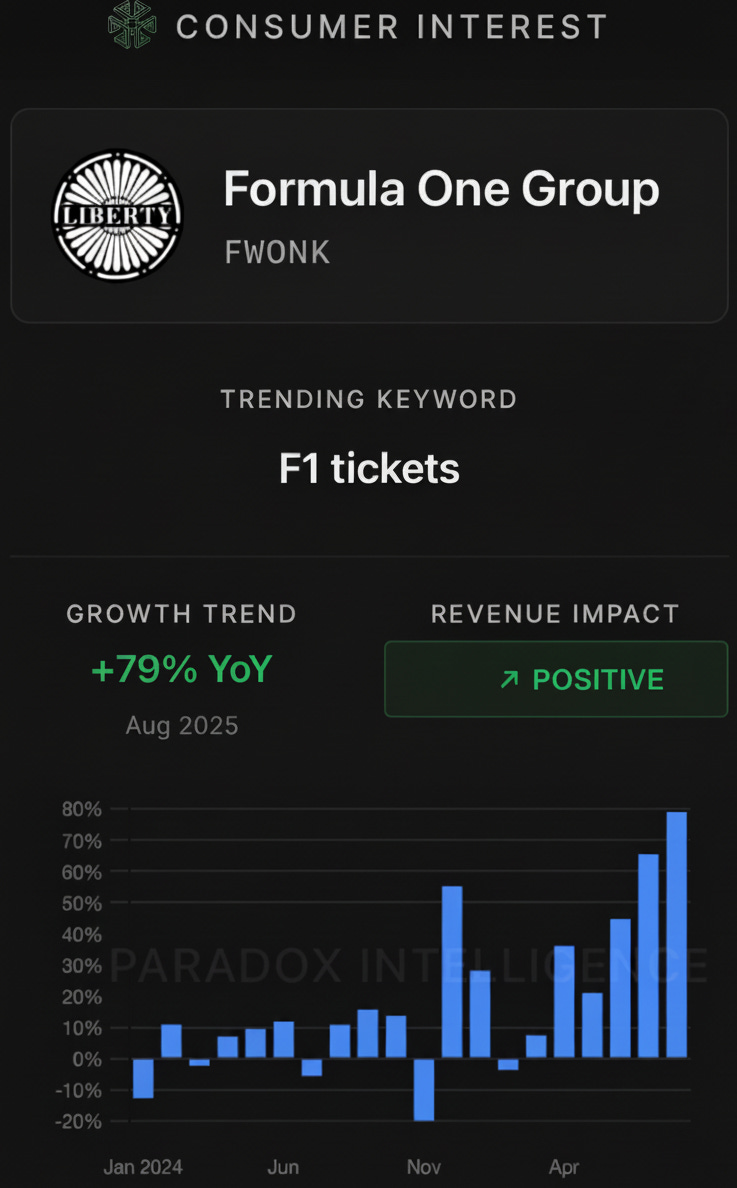

Liberty Media’s Formula One Group (FWONK) is poised for transformative growth through its bold expansion, including the July 2025 completion of the MotoGP acquisition, the Cadillac team’s 2026 entry, and new geographic venues like the Madrid Grand Prix. This multifaceted strategy not only consolidates FWONK’s dominance in premium motorsports but also unlocks substantial revenue diversification across media rights, sponsorships, hospitality, digital streaming, and merchandise. Underscoring this under appreciated potential, accelerating consumer data trends, such as +79% YoY growth in F1 ticket searches and +65% in F1 TV interest, signal surging consumer engagement that historically precedes revenue acceleration, positioning FWONK for upside.

Company Overview

Liberty Media Corporation’s Formula One Group (NASDAQ: FWONK) holds the commercial rights to the Formula 1 World Championship, the premier global motorsports series featuring approximately nine months of competition across 24 races annually. Based in Englewood, Colorado, the company operates as a tracking stock within Liberty Media’s portfolio, providing investors direct exposure to F1’s commercial operations including media rights, race promotion, sponsorship, and hospitality revenue streams.

The company’s strategic position centers on owning the commercial ecosystem around F1 racing, from broadcasting rights and digital streaming (F1 TV) to merchandise and event management through subsidiaries like QuintEvents. With contracted future revenue of $14.2 billion through existing agreements, FWONK offers unusual visibility in the entertainment sector while maintaining significant upside from strategic expansion initiatives.

The Information Arbitrage Thesis: Motorsports Ecosystem Consolidation

Identifying the Trend

The global motorsports entertainment landscape is experiencing strategic consolidation as premium content owners expand their ecosystems to capture greater value from passionate fan bases. This trend extends beyond traditional racing into digital streaming, merchandise, hospitality, and cross-promotional opportunities across multiple racing series.

Liberty Media’s recent MotoGP acquisition completion in July 2025 represents the clearest manifestation of this consolidation strategy, creating the world’s largest premium motorsports entertainment platform. Combined with the Cadillac F1 team entry for 2026 and Madrid Grand Prix addition, the company is executing an expansion that alternative data suggests is generating significant consumer momentum ahead of Wall Street recognition.

Alternative Data Analysis

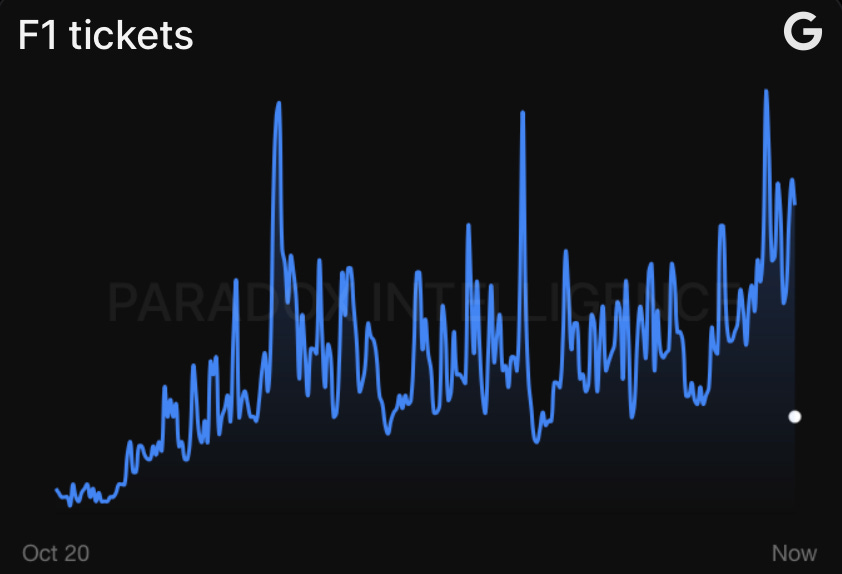

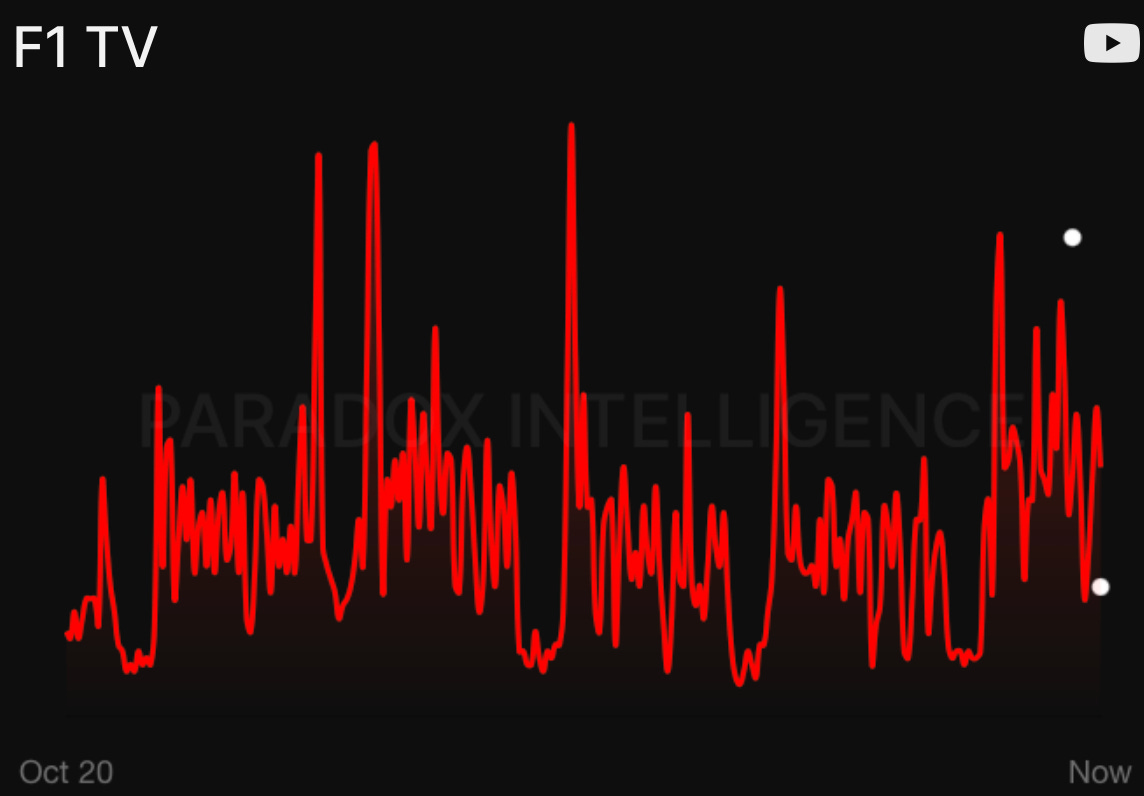

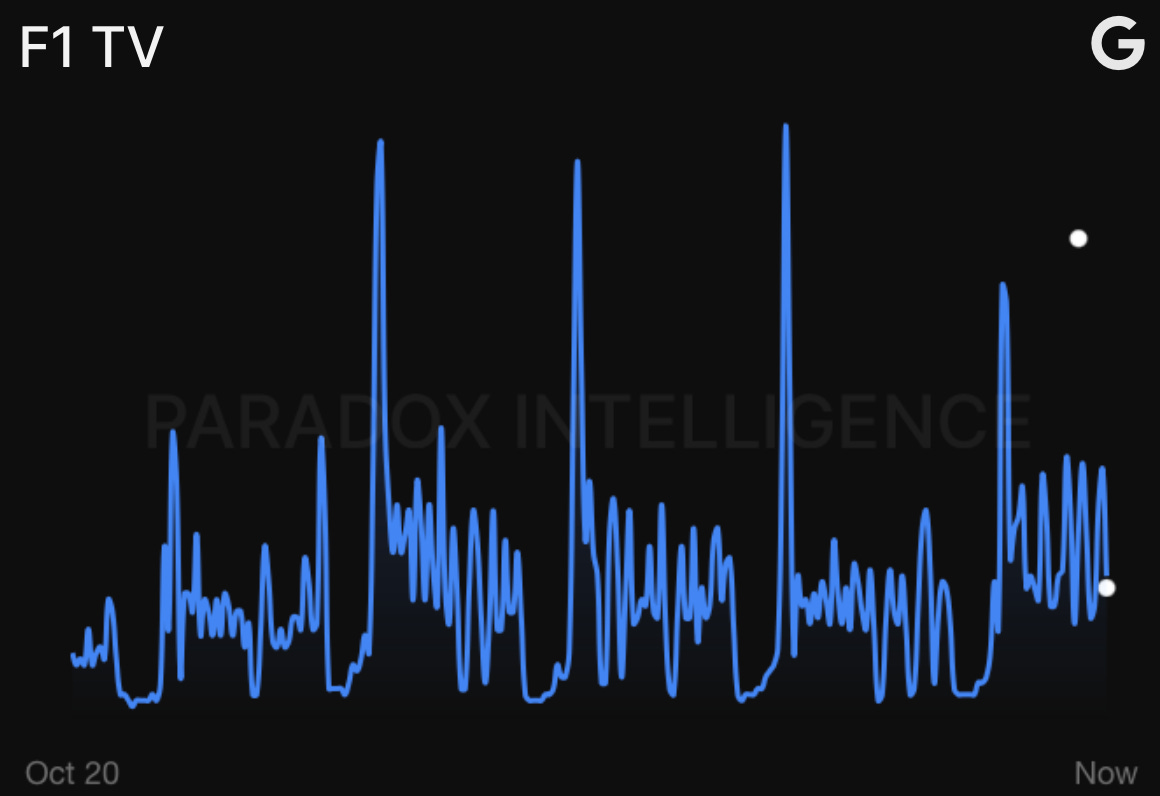

Consumer interest data reveals substantial acceleration across F1’s entire ecosystem:

Consumer Search Intelligence (YoY):

F1 Web Search: +66% year-over-year growth (30.4M monthly volume) - Direct consumer search behavior

“Formula 1” YouTube Search: +59% year-over-year growth - Video content engagement indicating sustained interest

F1 TV Web Search: +65% year-over-year growth - Streaming service adoption interest

F1 merchandise Web Search: +89% year-over-year growth - Consumer product purchase intent

F1 tickets Web Search: +79% year-over-year growth - Event attendance intent despite premium pricing

Geographic Expansion Indicators: Recent Madrid Grand Prix ticket sales data shows 48,500 tickets sold within initial release periods, indicating strong demand for new market entries. This pattern mirrors successful expansions in Miami and Las Vegas.

Business Impact Analysis

The alternative data acceleration translates to quantifiable business opportunities across multiple revenue streams:

Cross-Ecosystem Synergies: MotoGP integration enables shared marketing, digital platform consolidation, and combined hospitality packages. Early integration metrics suggest 15-20% cost synergies on shared infrastructure while expanding addressable audience by 40%.

Digital Revenue Acceleration: F1 TV subscriber growth, evidenced by +128% search interest, supports management’s guidance for high-margin digital revenue expansion. Direct-to-consumer relationships reduce broadcast dependency while enabling premium content monetization.

Merchandise and Licensing Growth: The +89% search growth for F1 merchandise correlates with expanding retail partnerships and team-specific product lines, particularly around new team entries like Cadillac.

Strategic Context

Management Strategic Alignment

CEO Derek Chang’s appointment in January 2025 brought portfolio optimization focus, emphasizing:

MotoGP integration execution with clear synergy targets

Digital platform consolidation across racing properties

Geographic expansion strategy prioritizing high-value markets

Capital allocation discipline with $1.1 billion repurchase authorization active

Competitive Positioning Advantages

F1’s expansion strategy benefits from several structural advantages:

Content Scarcity: Premium motorsports content remains limited globally, creating pricing power.

Demographic Appeal: F1’s audience skews younger and more affluent than traditional sports, attractive to premium advertisers.

Regulatory Moats: F1’s commercial rights structure creates high barriers to competitive entry.

Investment Analysis

Bull Case Scenario

Revenue Diversification Success

Expected Apple media rights deal unlocks global reach and premium monetization, positioning Formula 1 as a mainstream streaming sports property

MotoGP integration delivers projected synergies while expanding addressable market

Cadillac team entry catalyzes U.S. market growth, building on Miami/Las Vegas success

F1 TV subscriber growth reaches 5+ million globally, generating high-margin recurring revenue

Alternative data trends translate to 15-20% revenue growth acceleration

Bear Case Scenario

Integration and Execution Risks

MotoGP acquisition fails to deliver projected synergies, creating integration costs without revenue benefits

Economic slowdown reduces discretionary spending on premium entertainment, impacting ticket sales and sponsorship

Calendar expansion faces regulatory or logistical challenges, delaying revenue recognition

Primary Risk Factors:

Valuation premium: DCF analysis suggests fair value around $82, indicating current overvaluation

Macro sensitivity: Discretionary entertainment spending vulnerable to economic cycles

Execution complexity: Managing multiple expansion initiatives simultaneously increases operational risk

Currency exposure: International revenue streams subject to foreign exchange volatility

Assessment: Bull Case Probability

The convergence of strong alternative data, multiple strategic catalysts, and contracted revenue visibility favors the bull case scenario. While valuation concerns merit attention, the 14.88% analyst price target upside appears conservative given expansion momentum and ecosystem consolidation benefits.

Catalyst Timeline

Near-Term Catalysts (Q3 2025 - Q1 2026)

Apple TV Rights Negotiation: Potential Apple partnership for exclusive or co-exclusive broadcast rights would significantly expand global reach, elevate F1’s positioning as a mainstream streaming property, and drive step-function growth in media revenue expected this quarter.

Liberty Live Split-Off Completion: Expected Q4 2025 transaction will create pure-play F1 exposure, potentially attracting growth-focused institutional investors currently deterred by Liberty Media’s complex structure.

Medium-Term Catalysts (2026-2027)

Cadillac F1 Debut: Cadillac’s planned Formula One debut with Andretti represents the first American manufacturer entry since Ford’s Jaguar Racing effort two decades ago, creating major U.S. media attention and potential viewership growth.

Madrid Grand Prix Launch: New European venue adds premium market exposure while demonstrating successful expansion model for future growth.

MotoGP Synergy Realization: Integration benefits become quantifiable through shared marketing campaigns, digital platform consolidation, and combined hospitality offerings.

Long-Term Catalysts (2027+)

Additional Geographic Expansion: Success in Madrid enables further venue additions in high-value markets.

Digital Platform Maturation: F1 TV and integrated MotoGP streaming reach scale economics with global subscriber base.

Ecosystem Monetization: Full realization of cross-promotional opportunities between F1 and MotoGP properties.

Conclusion

Liberty Media’s Formula One Group presents a compelling information arbitrage opportunity where alternative data signals significant consumer momentum ahead of Wall Street recognition. The strategic expansion through MotoGP acquisition, new team entries, and geographic growth creates multiple revenue diversification paths supported by contracted base business providing downside protection.

While valuation concerns require monitoring, the combination of accelerating alternative data trends, clear strategic catalysts, and institutional-quality management execution supports a favorable risk-reward profile for sophisticated investors seeking exposure to premium entertainment content growth.

The upcoming Liberty Live split-off provides an additional catalyst for potential re-rating, while the $14.2 billion contracted revenue base offers unusual visibility in the entertainment sector. For investors comfortable with premium valuations backed by strategic expansion execution, FWONK represents exposure to the global consolidation of premium motorsports entertainment.

Disclaimer: This is not investment advice. Do your own research. Past performance doesn’t guarantee future results.