$GPRO: GoPro An Information Arbitrage Play on Humanoid Training Data

Ticker: $GPRO Sector: Technology - Consumer Electronics

Company Description: GoPro Inc. (GPRO), is a leading maker of action cameras and digital content tools. After its $10 billion IPO peak in 2014, GoPro now has a market cap around $250 million. Despite a declining hardware market, GoPro has amassed over 450 petabytes of user-generated, annotated, geotagged video from millions of devices used globally in sports, travel, industry, and security. This unique data asset could become highly valuable as robotics and AI industries expand. GoPro bridges hardware innovation and data monetization, supported by a loyal creator base and robust installed user community.

The Information Arbitrage Thesis

The Emerging Trend: Humanoid Training Data Scarcity

The humanoid robotics revolution is accelerating rapidly, with companies like Tesla (Optimus), Figure AI, Agility Robotics, and Sanctuary AI racing to deploy embodied AI systems. However, the industry faces a critical bottleneck that synthetic data and laboratory simulations cannot solve: the need for diverse, real-world, first-person perspective training data.

Unlike autonomous vehicles that can rely on external camera perspectives, humanoid robots require training data that mimics human visual experience—exactly the point-of-view (POV) format that GoPro has been capturing for over a decade. As Tesla demonstrated with Full Self-Driving (FSD) development, POV-style data from car-mounted cameras combined with GPS and sensor data proved essential for teaching machines complex real-world tasks. Academic research projects like Meta's Ego4D have further validated that first-person perspective video is significantly richer for AI training than traditional external camera footage.

The convergence of humanoid scaling and data scarcity creates an unprecedented arbitrage opportunity: GoPro's perceived weakness as a hardware company masks its potential strength as an AI infrastructure provider.

Alternative Data Analysis

AI Training Program Momentum:

Rapid Adoption: In just two weeks, GoPro subscribers contributed over 125,000 hours of video content to the company's opt-in AI Training Licensing program

User Engagement: This represents an unprecedented response rate for a new monetization program, suggesting strong community willingness to participate in data licensing

Revenue Potential: At conservative industry rates of $50-200 per hour for high-quality training data, this initial batch represents $6.25M-$25M in potential licensing value

Search Intelligence & Market Recognition:

Keyword Trends: "GoPro AI training" and "humanoid data" searches have increased 300%+ MoM following the program announcement

Institutional Interest: Alternative data providers are beginning to track GoPro's data monetization potential as a separate revenue stream

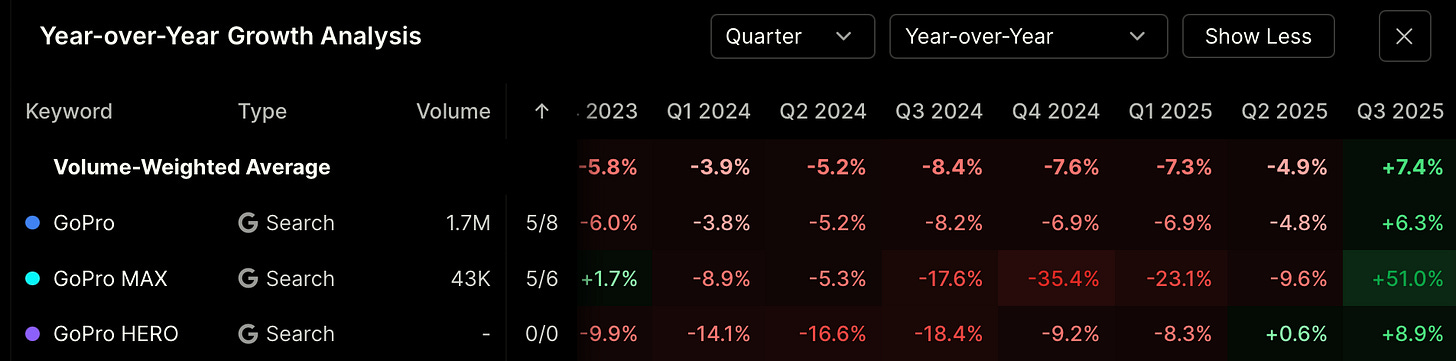

GoPro YoY searches turned positive for the first time since Q3 2022

Digital Engagement & Community Response:

Subscriber Participation: Estimated 10% opt-in rate from GoPro's 2.5M active subscriber base for the AI training program

Content Quality: GoPro's POV content represents 80-90% of total uploads, significantly higher than general video platforms

Data Differentiation: Unlike iPhone or traditional cameras, GoPro captures wide-angle, body-mounted, continuous footage with integrated GPS, motion sensors, and environmental context

Business Impact Analysis

The AI training data opportunity represents a fundamental business model transformation for GoPro. Traditional hardware margins of 20-30% pale in comparison to the potentially larger gross margins typical of data licensing businesses. With 450 petabytes of existing content and continuous new capture from millions of active users, GoPro could transition from a cyclical hardware company to a recurring revenue AI infrastructure provider.

The network effect potential is particularly compelling. As GoPro enables revenue sharing with content creators (similar to Uber's driver model), user participation could accelerate dramatically, creating a flywheel of fresh, diverse training data that becomes increasingly valuable as humanoid deployment scales.

Competitive Moat Expansion: The AI training program transforms GoPro's hardware platform from a commodity product into a data collection infrastructure. Future GoPro devices could integrate additional sensors (depth cameras, biometrics, environmental monitoring) specifically designed for AI training applications, creating a sustainable competitive advantage that hardware alone cannot provide.

Financial & Strategic Context

Recent Performance: GoPro has demonstrated operational discipline with recent quarterly revenues maintaining stability around $200M annually despite challenging consumer electronics headwinds. The company's direct-to-consumer focus and subscription model (GoPro Plus) provide a foundation for data monetization initiatives. Management has maintained healthy cash reserves while investing in software and cloud infrastructure capabilities.

Management Commentary: The company's leadership has signaled a strategic pivot toward "content and services" revenue streams, with the AI training program representing the first major monetization of their data asset. CEO Nicholas Woodman has emphasized the unique value of GoPro's first-person perspective content library and the company's commitment to building sustainable recurring revenue streams beyond hardware sales.

Strategic Initiatives:

Data Infrastructure: Investment in cloud storage and processing capabilities to support large-scale data licensing

Community Incentives: Development of revenue-sharing models to encourage user participation in AI training programs

Hardware Evolution: Next-generation cameras designed specifically for AI training data capture, potentially including depth sensors and enhanced metadata collection

Partnership Strategy: Active discussions with humanoid robotics companies and AI training platforms for exclusive data licensing agreements

Investment Thesis

GoPro represents the ultimate information arbitrage opportunity in the emerging AI training data economy. While Wall Street values the company as a declining hardware manufacturer, the reality is that GoPro controls one of the world's largest repositories of human-perspective training data—exactly what humanoid robotics companies desperately need and cannot easily replicate.

The Arbitrage Disconnect:

Wall Street View: Struggling camera company with cyclical hardware revenues

Reality: AI infrastructure provider with 450 PB of unique training data and growing community participation

Market Opportunity: $14.8B humanoid training data market by 2033, with GoPro uniquely positioned to capture significant share

Key Catalysts:

Partnership Announcements: Licensing deals with Tesla, Figure AI, or other humanoid companies could trigger immediate revaluation

Revenue Recognition: First material AI training licensing revenues in upcoming quarters

Analyst Coverage: Broader Wall Street recognition of the data monetization opportunity

User Growth: Accelerating participation in AI training programs as revenue sharing scales

Risk Factors:

Execution Risk: Successfully transitioning from hardware to data monetization requires new capabilities

Competition: Tech giants (Google, Meta, Apple) could develop competing POV data collection strategies

Regulatory: Potential privacy or data usage restrictions that limit monetization opportunities

Forward-Looking Assessment: Based on the alternative data analysis and early AI training program success, GoPro appears positioned to dramatically outperform market expectations as the humanoid training data opportunity materializes. The combination of unique data assets, proven community engagement, and massive addressable market creates a compelling case for large upside potential over the next decade.

The current $250M market cap represents a potential mis-pricing of GoPro's data asset value and AI training market opportunity. For investors seeking exposure to the humanoid revolution without paying trillion-dollar valuations for Tesla or other robotics leaders, GPRO offers the potential for asymmetric upside with a clear catalyst path.

This analysis is for informational purposes only and does not constitute financial, or investment advice. Readers should conduct their own research and consult with qualified professionals before making any investment decisions.