Introducing Thematic Catalysts

A lens on structural themes

Structural shifts and bottlenecks keep driving markets. They move names and sectors often before they show up clearly in headlines. We wanted to give our users a structured way to see and track that, so we built a dedicated tool and we’re releasing it now.

Thematic Catalysts is a lens on supply-side and structural themes. Bottlenecks keep showing up: chips, lithium, labor, logistics, power. We wanted a structured way to detect them, and Thematic Catalysts is that tool. It organizes themes around Categories, Resources, and Keywords so you can see where pressure is building, how it evolves over time, and which companies sit at the intersection of each theme. We use alternative data to spot major bottlenecks early and connect them directly to the stocks exposed.

What It Is

Category

Categories are high-level themes: AI Infrastructure, Materials, Energy, Healthcare, Supply Chain, Defense, Labor, Consumer Tech, Housing, Robotics, and others. Each category groups many resources and keywords. The category view gives you a quick read on which themes are heating up (intensity, year-over-year and month-over-month growth) and a sparkline of trend over time. You can navigate by category when you want to start from a theme and drill down.

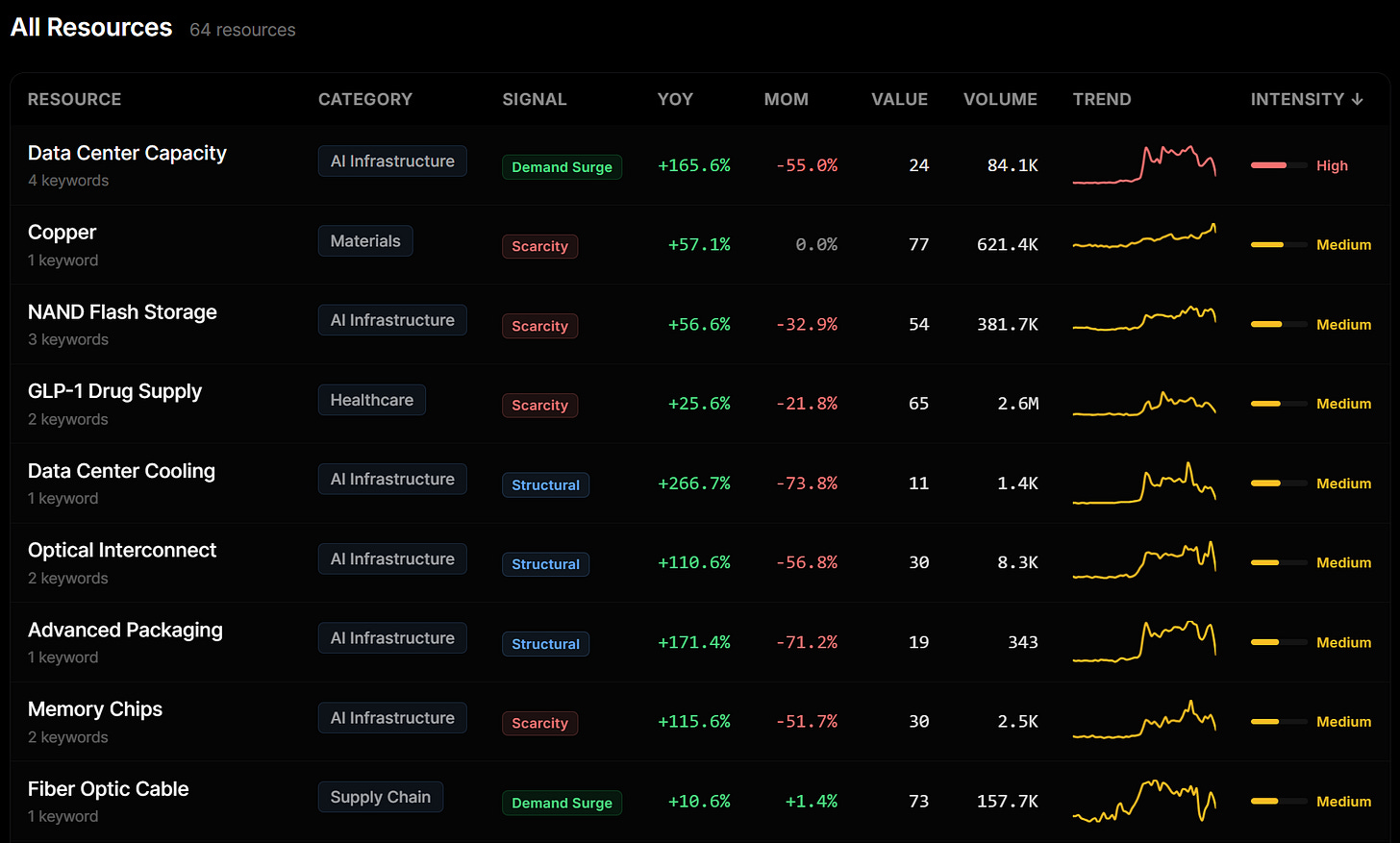

Resource

A resource is a specific bottleneck or structural topic within a category: for example, a particular commodity, component, or constraint. Each resource has a set of keywords we track and aggregate metrics (growth, volume, intensity) across them. The resource list under a category lets you sort by intensity, YoY, MoM, or volume so you can see which specific bottlenecks are moving most. Clicking a resource takes you to the keyword-level detail and time series.

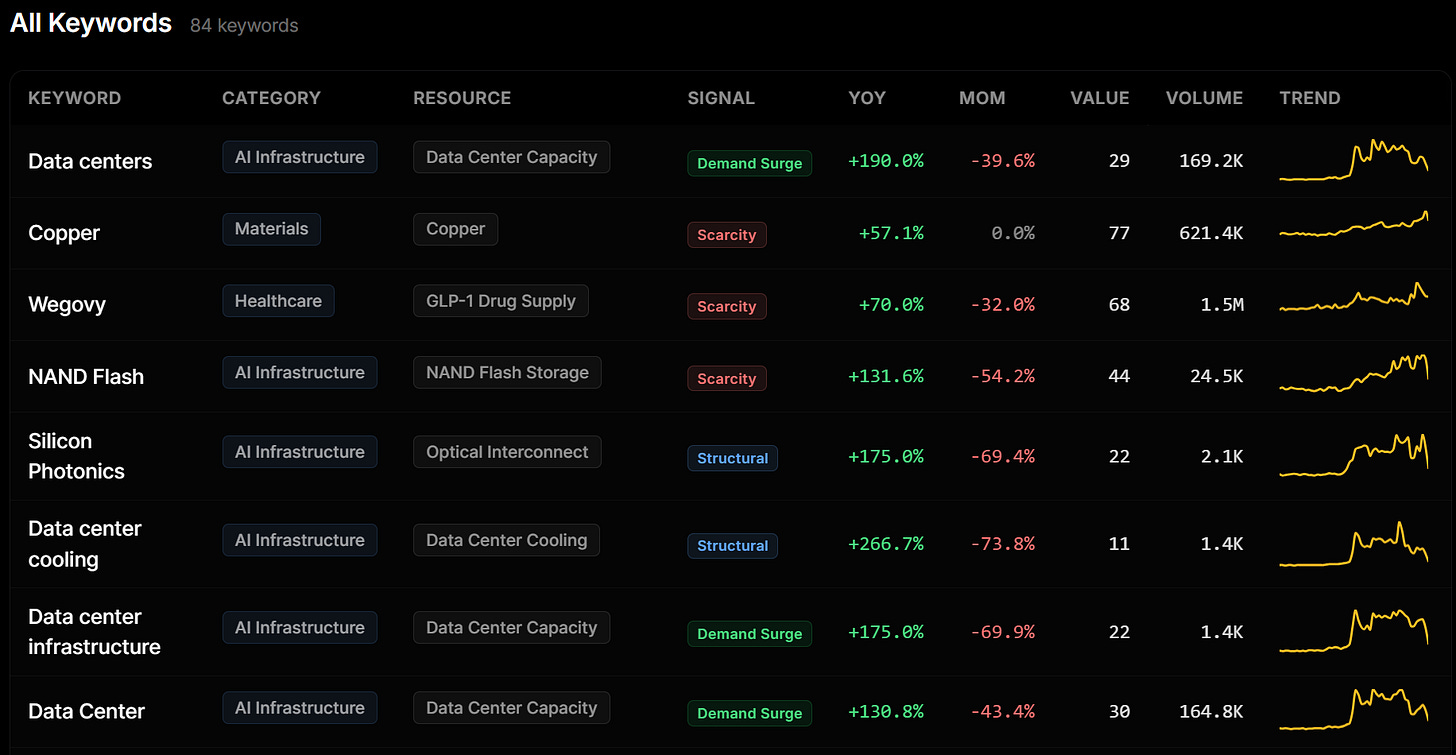

Keyword

Keywords are the actual search terms and signals we monitor: things like “chip shortage,” “lithium price,” or “grid capacity.” For each keyword we pull normalized data from multiple sources. You see a time series of how that signal has moved, a heatmap of which sources are lighting up, and growth metrics (value, YoY, MoM, volume) per source. Keywords are tagged with signal types (e.g. Scarcity, Demand Surge, Structural) so you can tell at a glance what kind of pressure they represent.

Why It Exists

Markets react to bottlenecks and structural shifts often before those stories make headlines. Search behavior, news volume, and sentiment across platforms can show where pressure is building. Thematic Catalysts is built to:

Track bottlenecks over time using alternative data, so you’re not relying only on lagging or narrative-driven news.

Detect change early by watching normalized trends and intensity across many sources in one place.

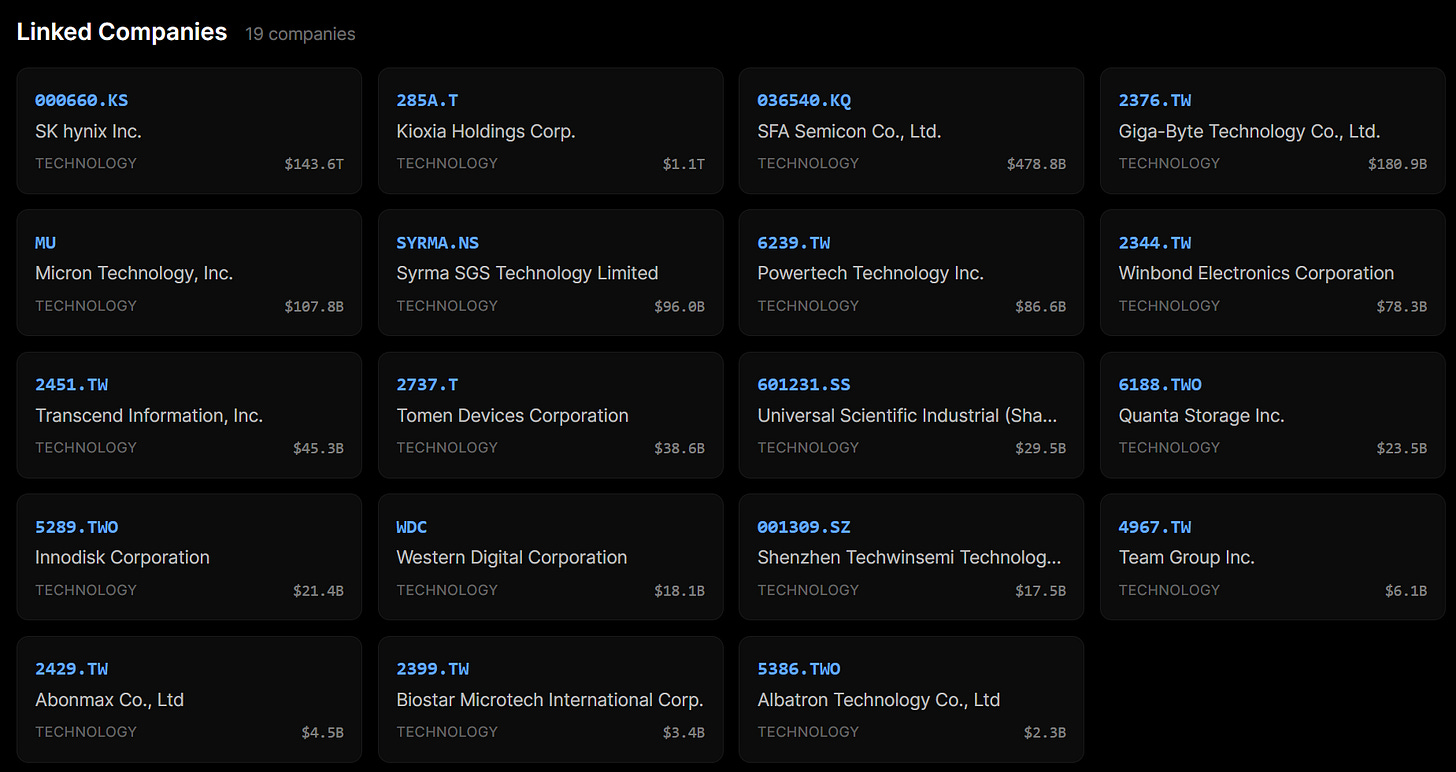

Connect companies to the theme so you can see which names are linked to each resource and keyword, with sector and market cap for context.

We aim to surface major bottlenecks early, before they dominate the news cycle, and to tie that signal directly to the themes and companies that are exposed.

How You Can Use It

You can enter the data in three ways:

By Category – Start from a theme, then drill into resources and keywords.

By Resource – Browse all resources across categories and jump to the ones that matter to you.

By Keyword – Browse all keywords and go straight to time series and source coverage.

Intensity (Low / Medium / High) and signal badges (Scarcity, Demand Surge, Structural) help you prioritize what to look at. The multi-source view and time series let you check whether a signal is broad-based or concentrated in one channel.

Get in Touch

If you want to explore the data, request access, or discuss how we can tailor it to your workflow, you can reach us at data@paradoxintelligence.com.