$LEVI: The Demin Jeans Trade

Ticker: $LEVI Sector: Consumer Discretionary - Apparel

Investment Thesis: Consumer search data indicates a fundamental shift back to premium denim, with Levi’s positioned to capitalize on sustained demand growth that extends beyond traditional fashion cycles.

Company Description: Levi Strauss & Co. (NYSE: LEVI) is the world’s largest brand-name apparel company and a global leader in jeanswear. Founded in 1853, the company designs, markets, and sells jeans, casual wear, and related accessories for men, women, and children under the Levi’s®, Dockers®, Signature by Levi Strauss & Co.™, and Denizen® brands. With operations in over 110 countries, Levi’s generates approximately $6.2 billion in annual revenue through wholesale, direct-to-consumer retail, and e-commerce channels.

The Information Arbitrage Thesis

The Denim Market Come Back Analysis

Search patterns indicate sustained consumer interest in premium denim categories that align with Levi’s market positioning. The trend includes both traditional fits and contemporary styles, including wide-leg and utility-focused designs that cater to evolving consumer preferences.

Alternative data suggests this shift has accelerated throughout 2025, with search volume patterns indicating sustained rather than seasonal demand. The convergence of return-to-office mandates, Y2K nostalgia trends, and preference for versatile clothing has created favorable conditions for established denim brands with strong heritage positioning.

Alternative Data Analysis

Consumer Search Intelligence

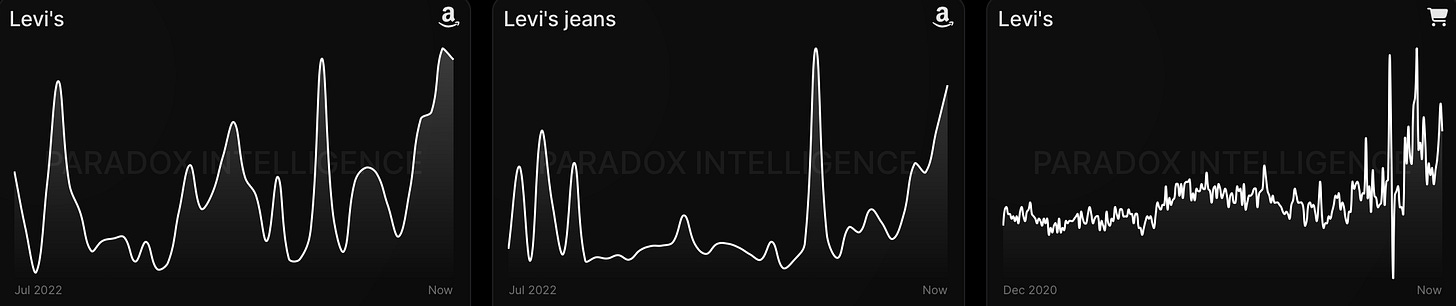

Levi’s Jeans Google Search: +59% YoY growth - Direct consumer search behavior indicating brand-specific interest

Levi’s Google Search: +52% YoY growth - Broad brand interest patterns across all product categories

Denim Jeans Google Search: +25% YoY growth - Category-wide consumer interest expansion

Search volume reaching new all time highs: 5 Years

Ecommerce Metrics

Levi’s Amazon Search Data: +47% YoY growth – Strong brand demand signal within marketplace environments

Levi’s Jeans Amazon Search Data: +29% YoY growth – Product-specific momentum indicating elevated conversion intent on Amazon

Levi’s Google Shopping: +94% YoY growth – High-intent digital shopping behavior accelerating across Google’s commerce surfaces

Search volume reaching new all time highs: 5 Years

Business Impact Analysis

The alternative data signals correlate strongly with Levi’s operational performance, suggesting that consumer search behavior is translating into actual purchase activity. This correlation indicates that digital interest is converting to sales at rates that exceed broader apparel industry benchmarks.

Consumer search patterns indicate geographic expansion opportunities, with international markets showing accelerated growth in Levi’s-related queries. This aligns with management’s strategic focus on international expansion and suggests potential for sustained revenue growth beyond domestic markets.

Financial & Strategic Context

Recent Performance

Levi Strauss delivered Q3 2025 results that exceeded analyst expectations across key metrics. Revenue reached $1.54 billion, representing 7% year-over-year growth, while gross margins expanded to 61.7% compared to 60.6% in the prior year period. Earnings per share of $0.34 surpassed consensus estimates of $0.31, demonstrating operational efficiency improvements alongside top-line growth.

The company has now achieved 12 consecutive quarters of positive revenue growth, indicating sustained execution capability rather than temporary market conditions. Direct-to-consumer sales grew 11% year-over-year, with e-commerce specifically increasing 16%, reflecting successful digital transformation initiatives.

Strategic Initiatives

Levi’s “REIIMAGINE” campaign partnership with Beyoncé generated significant measurable impact, creating $65 million in earned media value and contributing to 12% growth in women’s denim sales during Q3 2025. This demonstrates the company’s ability to execute culturally relevant marketing that translates to business results rather than just brand awareness.

The company’s focus on premium positioning and direct-to-consumer expansion has enabled margin improvement despite inflationary pressures. Management raised full-year 2025 guidance to 3% revenue growth with earnings per share expectations of $1.27-$1.32, indicating confidence in sustained momentum.

Final Assessment

Based on search volume correlation with historical financial performance, the probability-weighted scenario favors continued outperformance through mid-2026. Key variables to monitor include conversion rates of search interest to actual sales, international expansion execution, and consumer response to tariff-driven price increases. The significant search growth rates provide significant buffer for execution challenges while supporting above-consensus revenue growth expectations.

Disclaimer: This is not investment advice. Do your own research. Past performance doesn’t guarantee future results.