$META $EL.PA: The Smart Glasses Monopoly, An Asymmetric Opportunity

The iPhone moment for smart glasses is here - built for an AI-driven future

The II Part Asymmetric Thesis

We identify significant asymmetric upside in both $META and $EL.PA based on a two-part thesis that we believe the market has not yet recognized. If the thesis proves right, the upside is massive; if it doesn’t, the downside is limited. This represents an early-stage information arbitrage opportunity before broader market recognition.

Smart glasses have consistently failed in the past and are therefore not taken seriously by the market. Yet, we believe an inflection point is reached for reasons outlined below.

Risk Disclosure: All investments involve risk of loss. Past performance does not guarantee future results. This analysis is for informational purposes only and does not constitute investment advice.

Part I: Why Smart Glasses Can Become the Dominant Consumer Technology Platform

The next major computing platform transition is underway, focused on an AI driven future, and we strongly believe smart glasses—not VR headsets, not AR displays, but fashionable, good looking, smart glasses resembling normal eyewear will be the ideal consumer AI platform.

This platform can eventually replace smartphones as the primary consumer computing device because it solves fundamental problems that smartphones cannot. They keep you present, give AI context, work hands-free, and are always available.

For the first time in history, smart glasses:

Actually look good.

Offer a hands-free always on AI assistant.

Provide batteries that last long enough (8+ hours).

With each future iteration, the hardware evolves closer to its ultimate vision, delivering smarter, sleeker, and more seamless AI driven experiences ready for mass adoption. With over 1 billion people relying on glasses for vision correction and over 2 billion owning sunglasses, the total addressable market is massive. As smart glasses become more useful, the barrier to upgrading continues to drop.

Part II: Meta Platforms and EssilorLuxottica Have Already Won

The market underestimates the competitive moat that Meta and EssilorLuxottica have already built in smart glasses through their strategic partnership:

Meta brings the technology:

Advanced AI capabilities, social platform integration, decade of AR/VR R&D investment, and cloud infrastructure.

EssilorLuxottica brings glasses people actually want to wear:

Global brand portfolio of glasses people already love and own (Ray-Ban, Oakley, Persol), 180,000+ point of sale locations worldwide (LensCrafters, Sunglass Hut), eyewear design expertise, and consumer trust in optical products.

The monopoly: We believe no competitor can replicate this combination. Apple, Google, Amazon, and Microsoft have technology but lack fashion credibility and optical retail distribution. Traditional eyewear companies have brands but lack computing platform capabilities.

Company Overviews

Meta Platforms ($META) operates the world's largest social media ecosystem (Facebook, Instagram, WhatsApp) and has invested $60+ billion in Reality Labs to build the next computing platform. The company's smart glasses partnership with EssilorLuxottica represents the commercialization of this decade-long investment.

EssilorLuxottica ($EL.PA) operates the world’s largest eyewear company with over $27+ billion revenue, owning iconic brands (Ray-Ban, Oakley, Persol) and the world's largest optical retail network (LensCrafters, Sunglass Hut, Pearle Vision). The company's partnership with Meta monetizes their distribution infrastructure and brand equity in the emerging smart glasses category.

The Computing Platform Shift Thesis

Why Smart Glasses Will Now Succeed Where Previous Attempts Failed

Historical computing platform transitions share common characteristics: they solve fundamental user problems while improving on predecessor limitations. Smart glasses address critical smartphone deficiencies:

Attention Preservation: Smartphones fragment attention and remove users from physical interactions. Smart glasses maintain social presence while providing digital augmentation.

Contextual AI Integration: Unlike smartphones requiring explicit activation, smart glasses enable ambient AI assistance with visual and audio context awareness.

Hands-Free Operation: Critical for professional applications, driving, and accessibility use cases where smartphone interaction is impractical or unsafe.

Always-Available Computing: Eliminates retrieval friction that limits smartphone utility in many scenarios.

Technology Convergence Enabling Adoption

Three technological developments have reached sufficient maturity to enable mainstream adoption:

AI Revolution Alignment: Smart glasses seamlessly deliver real-time, contextual AI assistance that integrates effortlessly into daily life through both vision and audio, eliminating the need to reach for a device to engage.

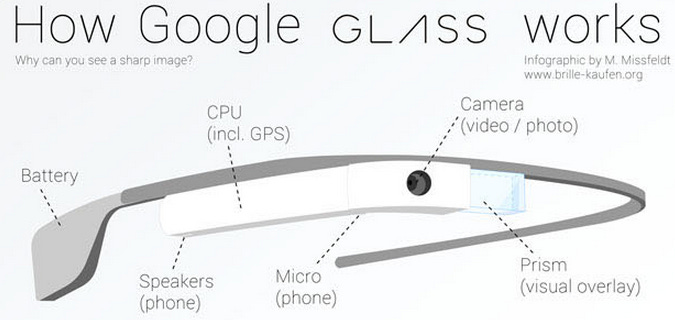

Miniaturization: System-on-chip designs now fit computing power in eyewear form factors

Battery Efficiency: 8+ hour battery life meets daily usage requirements

“Smart glasses eliminate the need to reach for a device to engage with your AI assistant”

Alternative Data: Consumer Interest

Search Trend Analysis

Global search data reveals significant and unprecedented consumer interest in Meta’s smart glasses technology:

Left Chart: Google search, Right Chart: TikTok hashtag mentions

Year-over-year growth: "Meta glasses" up 610% on Google and 937% on TikTok, indicating sustained momentum

Brand-specific searches: "Ray-Ban Meta glasses" showing explosive growth

Geographic distribution: Interest spanning North America, Europe, and Asia-Pacific

Market Implication: Search intensity typically precedes purchase behavior by 3-6 months, suggesting Q4 2025 and Q1 2026 sales acceleration.

Sentiment Analysis

Media coverage analysis shows predominantly positive coverage focusing on practical applications.

X Sentiment: 70-80% excited ("sci-fi vibes"); 20% flag privacy risks (e.g., doxxing demo) and AI glitches.

Reddit Sentiment: 60-70% positive, lauds daily usability, battery life; 30-40% note price concerns ($799).

Recent Meta Event Perception: Last week’s Meta event was seen as ambitious but marred by on-stage demo failures that sparked both skepticism and lively online debate.

While users flag some concerns, rapid advancements in smart glasses technology suggest future iterations will resolve these issues, accelerating mass adoption.

Competitive Positioning Analysis

The Meta-EssilorLuxottica Strategic Alliance

This partnership creates a unique competitive moat combining technology leadership with consumer brand credibility:

Meta’s Contributions:

Advanced AI and computer vision capabilities

Social media platform integration

Decade of AR/VR research and development

Cloud infrastructure and data processing

EssilorLuxottica's Contributions:

Global brand portfolio (Ray-Ban, Oakley recognition)

Worldwide retail distribution network

Eyewear design and manufacturing expertise

Consumer trust in optical products

Sustainable Competitive Advantages

Distribution Moat: EssilorLuxottica glasses are present in over 180,000 retail locations creating unmatched, almost instant, route-to-market for rapid smart glasses adoption. This means Meta’s smart glasses can reach over 500 million existing annual visitors globally almost instantly. Investors may underestimate this speed, expecting slower rollouts typical of new technology.

Brand Equity Moat: Ray-Ban and Oakley already represent $3+ billion in annual brand value, providing immediate consumer credibility that technology companies cannot replicate.

Data Network Effects: Smart glasses create valuable AI training data, improving product functionality and increasing switching costs.

Platform Lock-in: Integration with Meta's social ecosystem creates high switching costs as users invest in the platform.

“This means Meta’s smart glasses can tap into over 500 million existing annual store visitors globally almost instantly.”

Competitive Response Analysis

Big Tech Limitations:

Apple: Robust ecosystem but lacks eyewear expertise and partnerships; 2026 launch risks delays without fashion tie-ups, unlike established integrations.

Google: Google Glass's 2013 flop highlighted fashion/social hurdles; current efforts rely on partners like Warby Parker, but Warby Parker's direct-to-consumer model lacks the global optical retail scale and brand portfolio depth of EssilorLuxottica, limiting compatibility in premium fashion segments and hindering competitive replication at scale.

Amazon: Success in Echo/Alexa but sparse hardware wins beyond home devices; Echo Frames are audio-only, limiting AR/AI depth versus display-equipped rivals.

Microsoft: Enterprise-centric (HoloLens for military/industry); full consumer exit in 2025 cedes ground to AI-focused entrants like Meta/Google.

Barrier to Entry: The combination of fashion credibility, distribution network and technology expertise requires partnerships that competitors will struggle to replicate at comparable scale.

Financial Implications

EssilorLuxottica ($EL.PA)

For EssilorLuxottica, the world's largest eyewear maker, smart glasses are a lucrative evolution of its core business.

Higher Average Selling Prices: Traditional prescription glasses hover at $150–$300, but Ray-Ban Meta models command $300–$800, delivering a 2–3x premium. The newly unveiled Ray-Ban Display edition, launching at $799 on September 30, underscores this shift, blending fashion with functionality to justify the upcharge.

Sustained Profitability: Gross margins of 60–65% align with EssilorLuxottica’s traditional business, supported by premium components and brand equity.

Broader Market Opportunity: Beyond the 2.5 billion existing global eyewear users, smart glasses can also appeal to tech-savvy non-wearers, significantly expanding the addressable market, particularly among younger demographics embracing AR.

This shift positions smart glasses as an extension of EssilorLuxottica’s portfolio, driving revenue growth without compromising margins.

Meta Platforms ($META)

Meta’s $60 billion investment in Reality Labs, despite annual losses exceeding $16 billion, finds validation in smart glasses. Ray-Ban Meta sales reached $200 million in H1 2025, marking a breakthrough for its AR/VR ambitions.

New Revenue Streams: Smart glasses enable contextual advertising (e.g., location-based prompts) and data collection from cameras and microphones, enhancing Meta’s advertising platform with minimal privacy concerns.

Reality Labs Returns: After mixed results with Oculus, smart glasses offer a scalable, consumer-friendly entry point to Meta’s ecosystem.

AI Enhancement: Wearable data, user environments, interactions, and queries, refines Meta’s Llama models, strengthening its competitive edge in AI-driven personalization.

This positions smart glasses as a cornerstone of Meta’s long-term vision, transitioning its AR/VR efforts into a viable business.

“Beyond the 2.5 billion existing global eyewear users, smart glasses can also appeal to tech-savvy non existing wearers, significantly expanding the addressable market”

Partnership Economics: Mutual Gains

The Meta-EssilorLuxottica alliance, deepened by Meta’s $3.5 billion acquisition of a ~3% stake in July 2025, establishes a collaborative model that divides responsibilities along each partner’s strengths.

Revenue Allocation: EssilorLuxottica manages hardware production, branding, and retail distribution through its network of 18,000+ retail locations, securing robust margins on physical sales. Meta focuses on software, AI features (e.g., Meta AI subscriptions), and data-driven services, capturing licensing and ecosystem revenues.

Competitive Moat: Seamless integration of Ray-Ban’s style with Meta’s technology fosters user loyalty and high switching costs, positioning the duo ahead of fragmented rivals like Google’s Android XR platform.

Capital Efficiency: EssilorLuxottica integrates cutting-edge AI without substantial R&D outlays, while Meta accelerates global rollout by tapping EssilorLuxottica’s established supply chain and retail footprint.

This structure harnesses complementary capabilities to lead the smart glasses market. The partnership promises enduring value for both firms and their stakeholders.

Risk Assessment

Technology Execution Risks

AI processing capabilities may not meet consumer expectations initially

Manufacturing scale challenges as demand accelerates

Battery life limitations could constrain adoption in early generations

Market Adoption Risks

Consumer behavior change typically requires 3-5 years for new computing platforms

Privacy concerns around always-on cameras and microphones

Social acceptance challenges in certain environments and demographics

Competitive Risks

Apple entry with superior technology integration could disrupt market positioning

Pricing pressure from low-cost alternatives reducing margin expectations

Platform fragmentation limiting network effects and ecosystem development

Regulatory and Legal Risks

Privacy regulation could limit data collection and AI capabilities

Safety standards may require compliance investments

Antitrust concerns around Meta's platform dominance

Partnership-Specific Risks

Strategic alignment between partners may diverge over time

Revenue sharing disputes could destabilize collaboration

Brand management conflicts between technology and fashion priorities

Investment Considerations

A dominant smart glasses platform could mirror the iPhone’s transformative impact for Meta and EssilorLuxottica. If smart glasses emerge as the primary consumer computing interface, their expansive market could drive significant growth.

Meta ($META): Higher volatility with substantial upside tied to an AI-driven platform shift, leveraging software and ecosystem control.

EssilorLuxottica ($EL.PA): Lower volatility with consistent margin growth, bolstered by hardware expertise and global retail scalability.

The Meta-EssilorLuxottica partnership’s competitive strengths position it as a leader in the evolving smart glasses market, offering investors an opportunity to evaluate early its potential impact on revenue.

Conclusion

The Meta-EssilorLuxottica alliance, combining technological innovation with unmatched brand and distribution strength, positions $META and $EL.PA as leaders in the smart glasses market. Our data suggests adoption is accelerating faster than expected, despite broader market skepticism about computing platform shifts. For investors seeking exposure to the next computing paradigm, these companies offer compelling opportunities with distinct risk profiles, underpinned by a partnership that competitors will struggle to match.

Thoughts on potential futuristic use-cases:

Smart glasses reduce language barriers - Real-time translation of any text or conversation you see and hear, making foreign travel and international business seamless.

Smart glasses will augment human memory - Never forget a person's name, face, or important details again. Your glasses remember everything and provide contextual reminders.

Smart glasses will transform every worker into an expert - Mechanics see repair manuals overlaid on engines, doctors access patient data and medical references instantly, technicians get step-by-step guidance for complex procedures.

Smart glasses will revolutionize shopping - Look at any product and instantly see price comparisons, reviews, alternatives, and availability across all retailers without touching your phone.

Smart glasses can replace traditional GPS - Turn-by-turn directions appear directly in your field of vision, with contextual information about restaurants, landmarks, and points of interest as you walk or drive.

Extra: Why Google Glass failed

High price – At $1,500, it was far too expensive for the average consumer.

Unfashionable design – The bulky, futuristic look drew unwanted attention, made users uncomfortable, and earned wearers the nickname “glassholes”.

Privacy concerns – People worried about being secretly recorded, leading to bans in bars and public places.

Lack of clear use cases – Google never defined whether it was an everyday accessory or a situational tool, leaving consumers confused about why they needed it.

Better alternatives – Phones and other gadgets offered cheaper, more powerful features (better cameras, storage, battery life).

Suggested review materials

https://www.grandviewresearch.com/industry-analysis/smart-glasses-market-report

https://www.podscan.fm/podcasts/the-wall-street-journal-podcast/episodes/xiaomi-ai-glasses-launched-goldman-sachs-predicts-arai-glasses-market-to-grow-56-cagr-over-decade-supply-chain-golden-opportunity

https://chinabizinsider.com/morgan-stanley-the-ai-glasses-arms-race-is-on-and-china-is-coming-for-meta/

Risk Disclosure: All investments involve risk of loss. Past performance does not guarantee future results. This analysis is for informational purposes only and does not constitute investment advice.