The ChatGPT moment for Humanoids

How to Position for the Humanoid Revolution. Tickers: 688017.SH, 6324.T, 6268.T, 6506.T, 688322.SH, 2498.HK, 9880.HK

Watch this video.

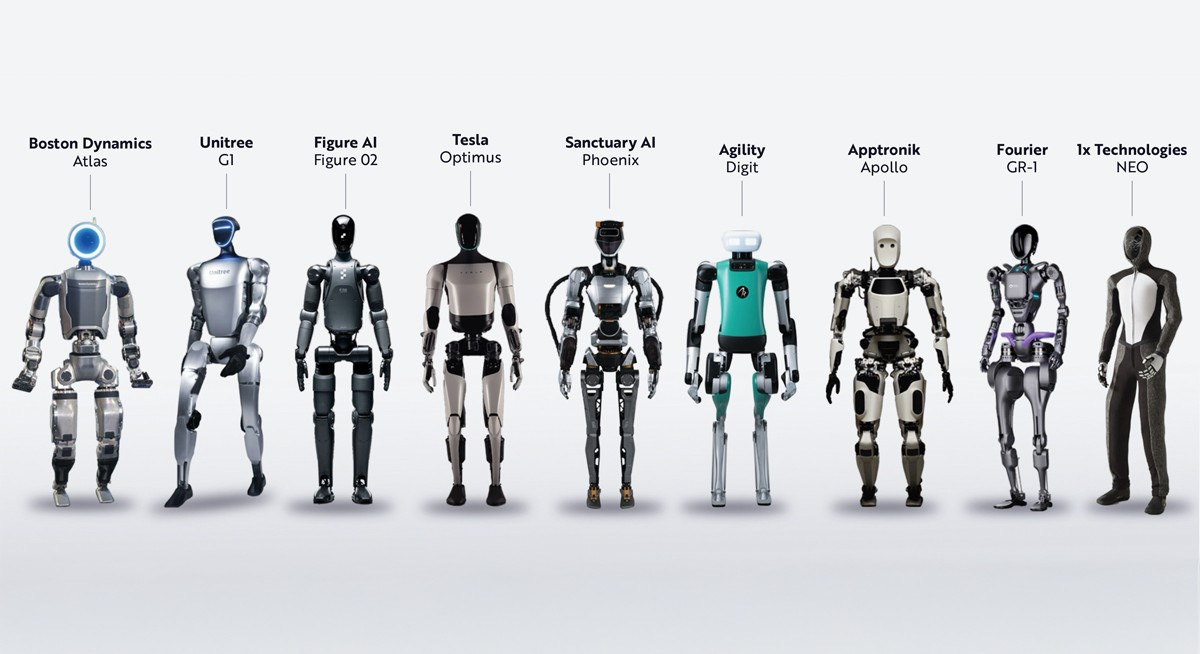

We predict a ChatGPT-like moment for humanoid robots is imminent.

This directly reflects Paradox Intelligence’s core philosophy: major change creates exceptional investment opportunities. We focus on identifying these inflection points early, before they become obvious to the broader market and mainstream media.

The explosive progress in humanoid robotics is exactly this type of opportunity. That is why we are doing a detailed analysis now and will share recurring updates in the future diving into the anatomy of humanoids and the publicly traded companies positioned to benefit most from their inevitable widespread adoption.

Morgan Stanley estimates the humanoid robot market could exceed $5 trillion by 2050, including robots, components, and related services such as maintenance and support. The firm projects nearly 1 billion humanoid robots in use by mid century, with about 90% deployed in industrial and commercial settings rather than homes. Adoption is expected to remain gradual until the mid 2030s before accelerating as technology improves and costs decline. The research also highlights China’s strong lead in AI enabled robotics and supply chain capabilities, while emphasizing that advances in both hardware and embodied AI will be critical to widespread adoption.

Most investors judge humanoid potential through today’s limited prototypes and status-quo bias. This thinking risks severely underestimating the opportunity. Humanoid use cases will prove far broader than cars on the road, spanning factories, warehouses, logistics, construction, healthcare, eldercare, and entirely new domains hard to imagine now.

Exponential advances in hardware and AI make it inevitable that humanoid robots will soon surpass humans in both physical performance and cognitive ability for structured industrial tasks. In industrial settings they deliver decisive advantages: they eliminate safety risks, enable true 24/7 operation without breaks or meals, and improve continuously through software, becoming faster and more consistent than human workers. In a competitive world, adoption is not optional. Once one manufacturer uses humanoids to cut costs and boost output, rivals must follow or fall behind. Efficiency always wins. This dynamic guarantees rapid, widespread rollout across factories worldwide.

The market will be enormous, on the scale of the automobile industry, reshaping labor, productivity, and supply chains. We stand at the earliest stage of a clear inflection.

Once one manufacturer uses humanoids to cut costs and boost output, rivals must follow or fall behind. Efficiency always wins.

Real-World Deployments Already Underway

UBTECH Robotics demonstrates production readiness. Its Walker S2 humanoids run on Airbus aircraft assembly lines for precision tasks, Texas Instruments semiconductor production floors, BYD and Geely EV plants for parts handling and inspection, Foxconn electronics sites, and SF Express logistics centers. The company secured over 1.4 billion RMB in humanoid orders in 2025, shipped roughly 1,000 units, and plans 5,000 industrial units in 2026 scaling to 10,000 in 2027.

Other concrete examples confirm the momentum. Figure 02 completed an 11-month production run at BMW’s Spartanburg plant, handling more than 90,000 parts and contributing to over 30,000 vehicles with 1,250+ daily operating hours. Agility Robotics’ Digit moved 100,000+ totes in GXO Logistics warehouses and entered Toyota assembly plants for tote loading and unloading. CATL integrates humanoids directly into battery manufacturing lines for delicate assembly and quality checks. These are live, revenue-generating installations accumulating thousands of hours, not prototypes.

The Anatomy of a Humanoid and Its Indispensable Supply Chain

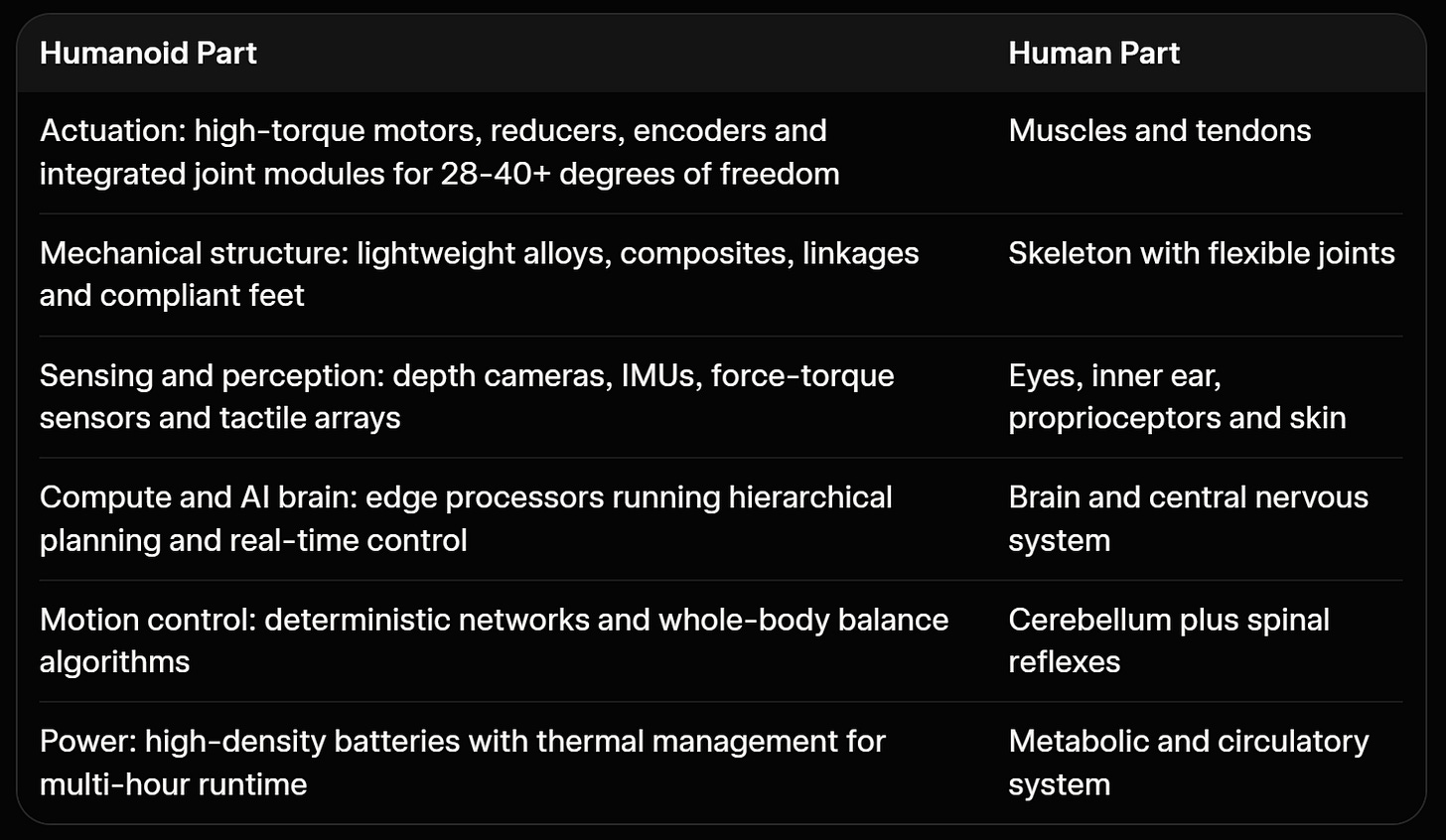

A functional humanoid integrates six core subsystems. It mirrors the human body. Actuation remains the primary technical and economic bottleneck.

This table compares the six core subsystems of a functional humanoid robot to their direct analogies in the human body.

Critical Supply Chain Exposures

We selected only publicly traded companies where at least 25% of total 2025 revenue comes directly from robotics or humanoid-relevant components. This filter keeps exposure clean and concentrated. Percentages are sourced from company filings and earnings reports. Market positions reflect 2025 data.

The supply chains are dominated by Japan and China. Tesla’s Optimus, for instance, relies heavily on Chinese component imports. This geographic concentration creates both opportunity and risk across the sector.

Actuation System Leaders

Leader Harmonious Drive Systems (688017.SH, China): 95-100% revenue from harmonic reducers for robot joints. Pure robotics play and dominant Chinese supplier.

Harmonic Drive Systems (6324.T, Japan): 65-75% from precision strain-wave reducers for high-torque joints. Global leader in this category.

Nabtesco (6268.T, Japan): 25-30% from RV reduction gears with 60% global share in medium-to-large robot joints.

Yaskawa Electric (6506.T, Japan): 44% from robotics segment including servos and actuators. Top global industrial robot player.

Sensing & Perception Leaders

Orbbec Inc. (688322.SH, China): 30-40% from 3D depth cameras and SLAM sensors. Holds ~70% share of Chinese robot 3D vision sensors and growing fastest.

RoboSense Technology (2498.HK, China): 25-35% from robotics LiDAR and manipulation-eye modules. Sold 303,000 units in 2025 (+1,142% YoY).

No other categories (mechanical structure, compute, motion control beyond overlaps, or power) have listed companies meeting the 25% revenue threshold.

Pure-Play Humanoid Exposure

UBTECH Robotics (9880.HK) remains the pure-play publicly traded humanoid company. It develops and manufactures full-stack Walker systems, hardware, motion control, and AI OS. already in commercial volume production.

Image: UBTECH S2 Walker

Investment Thesis

Humanoid scaling favors suppliers of the hardest subsystems and the systems integrator best positioned for volume. Actuation players capture the largest BOM share and technical moat; sensing providers ride the perception upgrade cycle; UBTECH monetizes end-product sales plus recurring software and service margins. China executes at cost and speed under policy support. Japan retains edge in precision reducers that no one has fully commoditized.

Risks exist: generalization beyond narrow tasks, regulatory timelines, and execution on cost curves. Current order books, shipment ramps, and factory deployments outweigh them. Production targets for 2026-2027 already point to multi-fold growth. Humanoids are expected to grow at 50% year over year.

These names provide the tightest public leverage to the transition. The shift mirrors the move from manual to automated assembly lines, only faster and broader. Early positioning matters.

This is not investment advice. Please do your own research.